- Foundation Repair Home

- Foundation Repair Cost: What are the variables?

- Does Insurance Cover Foundation Repair?

- Foundation Cracks

- Methods of Repair

- Piering: Fixing your home's issues

- Slabjacking: What is slabjacking?

- Related Information:

- Concrete repair: Repair methods and troubleshooting basics

- Read more about foundation information on FoundationRepairNetwork.com

- Houston Foundation Issues: Answers to common questions about foundation problems in Houston

Section Sponsor

Foundation Repair Near Me

Will Your Homeowner’s Insurance Cover Foundation Repair?

Find out if your insurance policy will help pay for foundation repairsCracks, settlement, and other types of damage to your concrete foundation are not only serious to the structural integrity of your home, they can also be very expensive to repair. Depending on the extent of the damage and the method of repair, you could be looking at a bill of up to $15,000 (See: Foundation Repair Cost). But if you think your homeowner’s insurance will foot the bill, you could be in for an unpleasant surprise.

DOES HOME INSURANCE COVER FOUNDATION REPAIR?

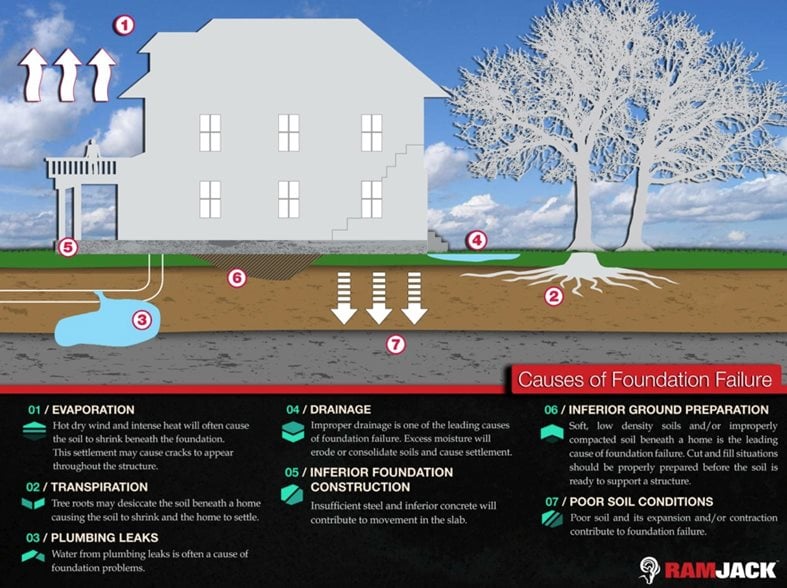

Start by checking your insurance policy. The most likely causes of foundation damage, such as soil expansion and contraction or poor construction, are typically excluded from most insurance policies (see table). Most carriers consider the conditions that contribute to foundation damage to be avoidable by keeping up with home maintenance and controlling conditions that can lead to flooding or inadequate drainage.

A typical homeowner’s policy covers your house only against specific, identified perils. Check your policy's declarations page to see what perils are named. If your foundation damage is the result of a covered risk—such as a tornado, explosion, or fire—your homeowner’s policy may reimburse you for the repairs up to your coverage limits.

When looking at your policy, Ram Jack, a network of foundation repair experts throughout North America, suggests looking for the following:

- Earth movement coverage

- Flood insurance

- Ground cover collapse coverage

What about broken pipes under the slab?

If you've experienced a slab leak, insurance coverage may kick in, especially if the cause was the result of a covered peril. However, you may have to pay for repairs yourself if the plumbing leak was the result of poor maintenance on your part.

| Cause of Foundation Damage | Covered by Insurance? |

|---|---|

|

Soil expansion and contraction |

No |

|

Construction defects |

No |

|

Explosion, fire, broken plumbing, wind damage |

Yes |

|

Earthquakes, flooding, sewer backups |

Typically requires supplemental coverage |

|

Foundation settlement |

No |

|

Drought |

No |

|

Poor drainage and soil erosion |

No |

|

Tree roots |

No |

|

General wear and tear |

No |

ADDING SUPPLEMENTAL COVERAGE

Depending on where you live and your exposure conditions, it may be worth purchasing supplemental insurance for perils not covered by your basic homeowner’s insurance policy. Most major insurance carriers will let you purchase a dwelling foundation rider to cover specific, limited perils, such as damage caused by a burst water pipe or water seepage. Most policies also offer supplemental coverage for damage caused by earthquakes, flooding, and sewer backups. However, foundation damage caused by settling, shifting, or earth movement is generally excluded.

DO YOU HAVE A FOUNDATION WARRANTY?

If your foundation problems are caused by defective construction or the use of poor materials, your homeowner’s insurance won't be of much help. However, some builders offer foundation warranties that cover labor and materials and structural defects for up to 10 years. If your home is fairly new, check to see if you have a warranty that’s still in effect, and read it over carefully to find out what’s covered.

If you’re buying a home, be sure to have the foundation inspected by a professional. You could save thousands of dollars and a lot of headaches by having any problems identified and addressed before you assume ownership.

Additionally, if you had foundation work done in the past check with the repair company. The best companies stand behind their work, some even offer lifetime warranties like RamJack.

OTHER PAYMENT OPTIONS

If repairs aren't covered, and you don't have enough money in your emergency fund, there are other ways to get help paying your bill. Many foundation repair companies will arrange same-as-cash payment plans and some even offer reduced interest financing options. See financing options offered by Ram Jack.

Learn more: How to Pay for Foundation Repair

BE PROACTIVE

If you're having foundation problems and notice the initial warning signs of foundation damage, get the problem repaired as soon as possible. By addressing these issues early, you could avoid more serious structural problems down the road. If you incur additional damage to your home caused by a foundation issue that isn’t repaired, your insurer could refuse to pay the claims for the repair costs.